By Rakesh Neelakandan

Content Specialist at StratAgile

“Sam’s are big stores in warehouse-type buildings aimed at small-business owners and other customers who buy merchandise in bulk. A membership fee entitles a customer to shop at Sam’s, which charges wholesale prices for name-brand, often high-end merchandise—everything from tires to cameras to watches to office supplies to cocktail sausages and soft drinks. If you’ve never been in one, they’re a lot of fun to shop…”— What Sam’s Club is in Walton’s own words.

1. The moonshot man on an airplane

Sam Walton…Walmart…Sam’s Club; connecting the dots was a plane, an airplane!

For Sam Walton, the founder of Walmart and Sam’s Club, sky was the limit, literally.

His wife Helen would ask him whether they really had to expand into opening more stores for they were having a good living. But she ceased asking him the question after the inauguration of the seventeenth store by Sam. At that point, Mrs. Sam “realized there wasn’t going to be any stopping.” [Now, Sam’s Club has 599 stores in the USA alone].

But back in the 1960s, Sam Walton had to crisscross the broad and long and straight highways of US to have a look and feel of his next potential store location. Those were the early days of discount boom. The frugal person that he was, had nevertheless, entertained an appetite for speed and convenience. So, he bought a plane, a putt-putting Air Coupe for $1,850.

“I loved that little two-seat plane because it would go 100 miles an hour—if you didn’t have the wind against you—and I could get to places in a straight line,” Sam wrote in his autobiography.

The aviator lines he drew connected his stores on the map of America although, the graph given below looks more like the trajectory of a NASA rocket. (The line graph is actually about the number of stores Walmart opened straddling two centuries, the latter half of the 20th century and the first decade of the 21st! If it were a rocket, this would have been its moonshot!)

Then came 1983 and with it arrived the concept of Sam’s Club. The idea of Sam’s Club or its operational model was not something new in the 1980s. Price Club Stores predated Sam’s Club all the way from 1976. But the constantly experimenting Sam took the concept to new heights as was his wont.

2. Sam’s Club: The present times

- Sam’s Club operates in 44 states in the U.S. and in Puerto Rico and also runs samsclub.com.

- Sam’s Club had net sales of $63.9 billion for fiscal 2021, representing 11% of (Walmart’s) consolidated fiscal 2021 net sales. Had net sales of $58.8 billion and $57.8 billion for fiscal 2020 and 2019, respectively.

- As a membership-only warehouse club, the income from the same is a significant component of the operating income.

- Sam’s Club operates with a lower gross profit rate and lower operating expenses as a percentage of net sales than other segments.

Walmart is fundamentally a discount business. Its ideal vision-mission statement as one looks at it, could be so simple that a minimally educated kid could scribble it making no spelling errors and a small-town merchant, (like Sam Walton) could execute it. It reads: buy it low, stack it high, sell it cheap. Credit goes to Walmart in really living up to this vision.

Now, the question becomes what makes Sam’s Club different from Walmart? See the table below:

|

# |

Sam’s Club |

Walmart |

|

1 |

Warehouse doubles up as a store |

Store is a store (although it is huge one) |

|

2 |

Paid, privileged but two-tiered, membership options |

No membership option akin to that of warehouse club membership |

|

3 |

Stocks commonly used merchandise that could be bought and sold in bulk. |

Stocks all types of merchandise with discount offers |

|

4 |

Wholesale price for merchandise with offers thrown in |

Retail price for merchandise with offers thrown in. |

|

5 |

Pellet storage and display |

Aisle storage and display |

|

6 |

Philosophy/ Model: buy it in bulk, stack it on pellets, sell them cheaper |

Philosophy/ Model: buy it low, stack it high, sell it cheap |

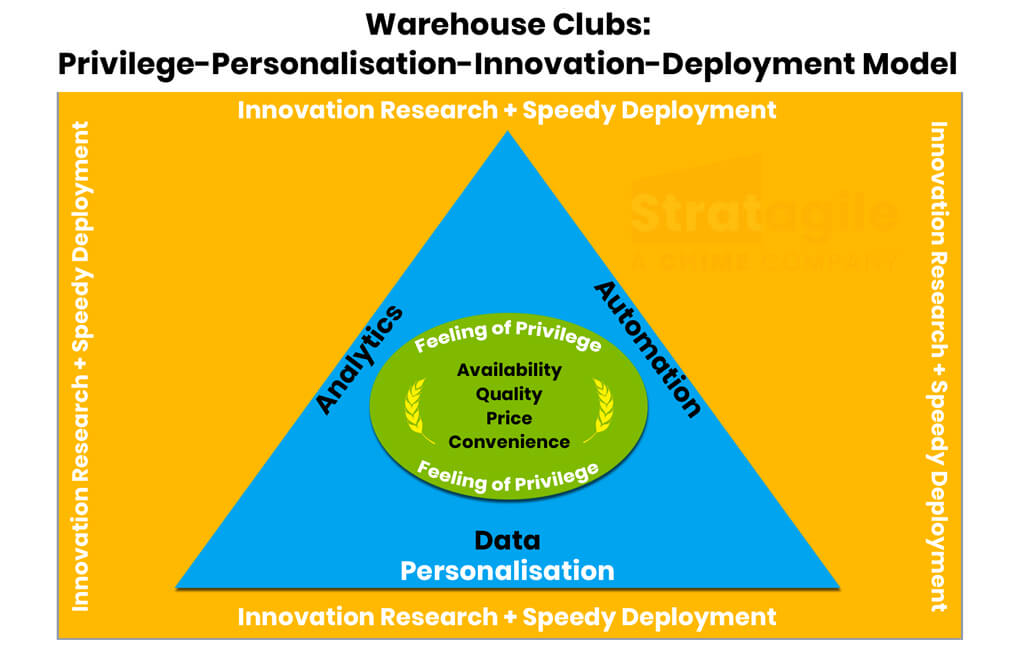

3. The PPID Model: A new looking glass

“Without the computer, Sam Walton could not have done what he’s done. He could not have built a retailing empire the size of what he’s built, the way he built it. He’s done a lot of other things right, too, but he could not have done it without the computer. It would have been impossible.” – Abe Marks, Former President of National Mass Retailers’ Institute; USA (Excerpt from the book ‘Made in America’ by Sam Walton, the Founder of Walmart).

3.1. Sam’s Club and its merchandise

At the heart of Sam’s Club PPID model as envisioned are two elements of paramountcy. The goods (as referenced to Availability, Quality, Price) and the members plus the information of the members (collected to facilitate Convenience) both of which are encapsulated in a Perimeter of Privilege. (See the diagram above). Everything else is rendered literally useless if devoid of these elements. So, what are those goods that Sam’s Club stocks for its members?

Sam’s Club offers merchandise in the following five categories:

|

# |

Category |

Sub-category |

|

1 |

Grocery and consumables |

Dairy, meat, bakery, deli, produce, packaged foods, beverages, snack foods, candy, other grocery items etc. |

|

2 |

Fuel and tobacco |

|

|

3 |

Home and apparel |

Home improvement, outdoor living etc. |

|

4 |

Consumer electronics and accessories |

Software, video games, office supplies, appliances etc. |

|

5 |

Health and wellness |

Inclusive of pharmacy, optical services, hearing services etc. |

It is pertinent to translate this into SKU or Stock-Keeping Unit numbers on a comparative matrix with competition to measure the scale of the operations and to put things into perspective.

|

# |

Warehouse club |

Stock Keeping Unit (SKU) |

|

1 |

Sam’s Club |

6000-7000 |

|

2 |

Costco Wholesale |

3700 |

|

3 |

BJ’s Wholesale Club |

7200 |

The key insight that one can gather with this backdrop on, is the following: by simply making the package larger to add to sales, is tantamount to one shooting oneself in the foot. This is because fewer members will purchase the product which in turn will exert pressure on the already thin profit margin with direct bearing on profit and loss reports.

A rule of thumb to follow might be this. If you sell, say ‘X’ units of an item in conventional retail, a pack-size of the same item sold in a warehouse club should not be more than ‘2X’ or ‘3X’ meaning two-times or three-times the traditional retail pack-size.

This is demonstrative of a shift in the consumer behaviour.

3.2. Sam’s Club and its members

Sam’s Club offers two types of memberships: a Club membership and a Plus membership; the former comes at $45 a year and the latter at $100/ year. The Plus membership offers a range of perks like cash rewards, free shipping, early shopping, pharmacy benefits and optical services apart from other freebies. The perks just mentioned do not apply to Club membership.

But the Club membership has a range of other benefits as manifested as instant savings, fuel savings and add-on and complimentary membership other than free flat tire repair, battery testing and wiper blade installation all of which also apply to Plus membership.

Unconfirmed reports suggest that Sam’s Club had 47 million members in 2012. The current numbers are hard to come by. And if the latest announcements are anything to go by, then it is that Sam’s Club is on a winning streak.

“Members are getting into a stickier, more loyal relationship with us. And a lot of that is coming through some of the products and tech that we’ve delivered, which is, I think, truly living up [to] creating special experiences for members,” Kath McLay, the CEO of Sam’s Club said, recently. Yes, in in the first fiscal quarter of the year 2021, membership income climbed a whopping 12.7%, with the total membership reaching an all-time high!

At the end of the day, a Club membership is all about feeling special and privileged..

In order to facilitate and sustain these membership privileges with zero friction and fragmentation at a functional level, Sam’s Club collects a range of personal information of its members via different channels adhering to rules and policies.

Member’s personal information collected by Sam’s Club fall into the following categories:

|

# |

Type of information collected |

Examples |

|

1.0 |

Identifiers |

|

|

1.1 |

Personal identifiers |

Name, address |

|

1.2 |

Device, online identifiers |

Telephone number, email address |

|

1.3 |

Internet, application and network activity |

Cookie IDs and browser visits |

|

1.4 |

Government identifiers |

National identification numbers, driver’s license numbers |

|

2.0 |

Demographic information |

Age and date of birth |

|

3.0 |

Financial information |

Credit/ debit card numbers and claims information |

|

4.0 |

Health and health insurance info. |

Prescription numbers and health insurance identification numbers |

|

5.0 |

Characteristics of protected classifications |

Gender and nationality |

|

6.0 |

Purchase history information |

Products bought, rented and returned |

|

7.0 |

Location information |

Geo-location |

|

8.0 |

Sensory information |

|

|

8.1 |

Audio information |

Audio recordings |

|

8.2 |

Visual information |

Video recordings |

|

9.0 |

Employment information |

Occupation, title, licenses and professional memberships |

|

10.0 |

Education information |

Degree and schooling |

|

11.0 |

Preferences and characteristics |

Individual’s shopping pattern and behaviour |

Information acquisition channels:

|

# |

Name of the channel |

Channel description |

Nature of providing the info. From the PoV of the member (theoretical) |

|

1 |

Direct channel |

Provided directly by the cardholder/ member of the household |

Active providing |

|

2 |

Device channel |

Collected utilising a device that may be associated with the member or member’s household |

Passive providing |

|

3 |

In-store technology channel |

Facility cameras |

Agency in providing in real time |

|

4 |

Intra-group channel |

Information collected from another company within the family of companies that Walmart constitutes |

Record-sharing with prior consent |

|

5 |

Third party channel |

External sources |

– |

3.3. PPID & convenience at Sam’s Club: Glimpses of an experiment

Same day grocery delivery

In January 2018, announcement came in that Walmart, the parent company of Sam’s Club would draw shutters on 63 stores in the US and repurpose as many as 12of them to fulfill ecommerce orders. Within a month, another announcement arrived which provided Sam’s Club members same-day grocery delivery in three markets facilitated by a tie-up with Instacart in the regions of Austin andDallas-Fort Worth, Texas, and St. Louis, Missouri. [Now samsclub.instacart.com delivers groceries in multiple regions in the United States.]

Sam’s Club Now and its member’s experience (MX) digital

pivot

The year also saw the inauguration of a Sam’s Club facility spread across 32,000 square feet or just covering a quarter of a typical warehouse club sprawl.

“While this will be a membership club like all Sam’s Club locations, this club will be designed to help us innovate and improve our member experience,” wrote the then-CEO of the Club.

The value proposition of the Club was digital, inside out. The Club promised among many other things:

- Fast membership sign-up

- Easy returns

- Superfast checkout using Scan & Go facility (mobile checkout using scanning of barcodes with the member’s own camera): Sam’s Club Now mobile app.

- Digital signages throughout the club (electronic shelf labels)

- Same-day Club Pickup and delivery options. (Busy families would be benefitted).

- Camera system for inventory management

- Wayfinding technology for in-store navigation

- Augmented reality

- Artificial intelligence-infused shopping

- Cashiers repurposed as Member Hosts: [“Eliminating friction doesn’t mean replacing exceptional member service with a digital experience,” said John Furner, Sam’s Club President and CEO. “We know our members expect both.”]

Clearly, in keeping with the learning and experimenting spirit of Sam Walton, Sam’s Club was ‘borrowing’ ideas from Target and Amazon Go convenience stores.

In describing the new Sam’s Club, the then-CEO., Jamie Iannone used the word “convenience”, time and again.

The App was also envisioned to have a built-in map for zeroing in on the right aisle for a particular product. But overtime, it was also deemed to utilise beacon tech that would ultimately be tied to the shopping list of the Member and would chart an intra-store route adding to the effectiveness and efficiency of the shopping experience.

There would also be pre-populating carried out for a shopping list utilising the purchase data and frequent purchases with ‘remove’ option for member. The member, as a result, will not forget the things she usually needs to buy. A combo of ML or Machine Learning and customer purchase history would be deployed to meet this end.

The Augmented Reality feature of the app was also in the works with “stories’ about the products being sold and related features popping up on the screen. (History of Monsooned Malabar Coffee, anyone?).

All these technologies came from within the Sam’s Club’s innovation center.

“The vast majority of technologies that we’re building here are technologies that we’ve developed in house. There may be pieces of modules of things that we’re using from third parties. But the majority are systems that are building on the technology that we’ve developed here,” said Jamie Iannone who also manned the position of the EVP of Membership & Technology. “That allows us to iterate and move pretty quickly with it,” he noted.

At that point in time, the company had over 100 engineers in the domain and had plans to hire more people in the areas of ML, AI and computer vision. Dallas was decided to host the test market given the region’s availability of tech talent and the recruiting potential apart from its proximity to Walmart’s headquarters in Bentonville, Arkansas.

Fast forward to 2019: the news canning technology by then, had the capacity to recognise products from any angle and add it to the shopping cart. One need not had to be a sharpshooter to scan a barcode and get it just right.

- “These engineers in Bangalore, India built a new system that allows us to deliver eCommerce orders from both fulfillment centers AND clubs. The system has cut a whole day out of the supply chain.”

- “We call it ‘Ask Sam.’ You can speak into the App and ask anything about the club — just like you would your own phone. Ask Sam is now LIVE at all our clubs, and it’s already answered 1.5 million questions — all from associates who work at Sam’s Club.”

(John Furner, President and CEO at the Walmart Associate and Shareholders Meeting, 2019)

3.4. PPID & personalisation: Data, analytics and automation

A few years back, Sam’s Club had no tailor-made approaches to marketing for its members. Be it Harry or Sally, both of them received the same communications and ‘ditto offers’. But this picture changed beyond recognition as the ‘Decision Sciences’ team began to deliver on data-driven decision-making across the organisation. A star was born: a new targeting, gauging/ measurement, and optimization suite named ‘Omega’. The marketing team caught up with the change and did a course correction to include the use of randomized control trials, uplift models, and ML or Machine Learning to ‘deeply’ personalise and enhance the relevance of the communications.

“We went from chain-level marketing to member-level marketing using a member’s omnichannel behavior and experience to drive the messaging,” explained Agastya Kumar Komarraju, Associate Director, Head of CRM Analytics, Sam’s Club.

Big data technologies

Sam’s Club had long been using Apache Spark and Hadoop. From detecting fraud to recommending products, the business with billions of transactions and trillions of events, had to rely on big data technologies with all the work run on multiple on-premise Hadoop clusters.

However, as a part of its transition to public cloud, they had to build an enterprise scale data platform and Azure Databricks became a key component of the platform. This facilitated for Sam’s Club data scientists, engineers and business analysts the capability to work with the company’s data.

The uplift modelling helped in maximizing incremental sales by improved targeting and outreach. And as time passed by, by subjecting to test all direct mail campaigns through randomized control trials, the Club developed a rich collection of experiment data that in turn proved foundational for Omega suite.

The Persuadables and the like

If there is one insight that made Sam’s Club take a U-turn on targeting, then it was to make a shift from trying to nudge potential shoppers to be members (conversion trial) to zeroing in on a customer category that could be influenced by relevant advertising to shop at Sam’s Club (refined targeting). This segment was given an interesting nomenclature: the ‘Persuadables’.

Then there is this category of ‘Sure Things’ who are avowed shoppers at Sam’s Club, no matter what and the category of ‘Lost Causes’ who may not shop at Sam’s Club regardless of any sort of marketing campaigns run.

By deploying the uplift model of ML, the Club could establish a connect with the Persuadables category.

There are decision trees and propensity models but both these models fall short of uplift model in distinguishing Persuadables from Sure Things category. The strength of uplift approach lies in predictive modelling. Also known as “incremental models,” “true lift models,” or “persuasion models,” the model, per se, has helped the Club to contact lesser number of shoppers even as achieving better results.

Each campaign run by Omega is configured as a truly randomized test and as a result, the campaign and marketing team can figure out the incremental impact of the same. The model can even optimize the budget for the future based on the data it collects.

Yes, the members are constantly graded. Those members are reached out, and this is important: the members who score with a high need for an extra push to convert; only they are followed up with. Also, on the store front, the merchandising items that are not garnering incremental sales are replaced. Items with a propensity to deliver an uplift in renewals are stocked.

“If you just look at data around renewal rates, we know, what are those triggers that will tell us that we have a high likelihood to get a great renewal outcome? And so we look at how many members are on auto renewal? How many members have our credit card and they’re using it? How many members are using Scan & Go? How many members have an e-commerce account with us and are purchasing online? We’ve got the data that tells us by increment [whether a member is likely to renew].” Kath McLay said at a recent event.

|

# |

Omega suite in direct mail program and lift achieved in ROAS |

Compared with: |

|

1 |

More than 100% |

Randomised targeting |

|

2 |

Up to 51% |

Decision tree targeted segments |

|

3 |

Up to 12% |

Previously used propensity models |

The marketing team could easily point out withclarity both ROAS (Return on Advertising Spend) and member renewal ratesalong with products that give incremental sales and link the same to marketinginitiatives.

3.5. PPID: Innovation and speedy deployment

Sam’s Garage was another of the pilot projects which incorporated digital technology.

By virtue of the system, tire recommendations could be provided in less than 5 minutes which previously used to take 30 minutes. The beauty of the system is that against a specific member ID the data categories of in-club inventory, vehicle-industry data (specifications, trims, size) and years of member’s purchase history; all could be populated on a nationwide basis at the tap of a finger. A desktop, multi-system and catalogue arrangement was replaced by a mobile tablet. The total cost at the instance and the futuristic interventions that may be required to be carried out could also be anticipated and predicted using the historical data.

“The company said this tool goes beyond creating a better shopping experience; it also provides data that can be leveraged to ensure the member gets the best overall service in the future.” A report noted.

The Project to roll this out spearheaded by Suchi Vakkalagadda whose team literally rolled up their sleeves and dug deep into 600 clubs’ data which virtually translated into more than 1,100 data sources. That was just the beginning. All these (truckloads of) data were analysed and ordained to create the new system. The entire sets of operation were completed in less than 9 months: building, testing and rolling out across the entirety of the US. Add to this the nationwide rollout of curb side pickup at the height of the pandemic, Sam’s Club has come a long way in a short time.

Sam’s Club is also piloting new Scan & Go technology that explores an additional way to seamlessly get merchandise from a club location to a member’s front door. This pilot program, called Scan & Ship, is integrated into the retailers popular Scan & Go feature within the Sam’s Club app and will allow members to place direct-to-home orders in the aisle by scanning merchandise included in the program.

Scan & Ship offers an immediate in-club solution for items thatrequire large vehicles to transport such as playsets, patio furniture,mattresses, large TVs, grills, and more. It also gives members an opportunityto select alternate colours and sizes unavailable in the club. Scan & Shipallows the member to buy it and have it delivered to their desired destination– usually within three to five business days – with one simple digital transaction.

The Sam’s Club app experienced tremendous growth last year with 9.6 million downloads, according to AppTopia, almost twice as many downloads as competitor apps, and it boasts a 4.9 app store rating. Positive user reviews indicated that many members enjoyed the Scan & Go feature, which expanded to all Sam’s Club fuel stations in 2020 and saw a 43.5% adoption rate increase year-over-year in Q1.

“We challenge ourselves every day to develop and execute convenient solutions that disrupt the warehouse model and provide additional value to our members,” said Tim Simmons, Senior Vice President and Chief Product Officer at Sam’s Club.

“Just like Scan & Go, Scan & Ship gives members greatercontrol of their shopping experience. It’s exciting to see our team develop andlaunch the Scan & Ship pilot so quickly, and it has got great potential todeliver the ultimate omnichannel member experience across our entire chain.”

Innovation Jam

“Scan & Ship is the result of an internal program we’re really proud of called the Innovation Jam, which encourages associates to collaborate and develop prospective retail technology solutions during the two-day, sprint-like event,” said Vinod Bidarkoppa, Senior Vice President and Chief Technology Officer, Sam’s Club. “Scan & Go has been such a success story for us and Scan & Ship is a fantastic extension to all of the great innovation we already have in place.”

In addition to piloting Scan & Ship, the retailer launched a new feature at all clubs in July that gives members who don’t currently have the Sam’s Club app an opportunity to demo the Scan & Go feature without the commitment of downloading the Sam’s Club app onto their devices using instant app software. The approach gives members the chance to initially try Scan & Go without taking up storage on their devices.

The feature uses Near Field Communication (NFC) technology and only requires scanning a QR code to begin use. The demo, which allows members to key in a payment option, delivers on the experience of contactless shopping and skipping the traditional checkout line.

It can be used for purchases up to three times before a message prompts the members to download the Sam’s Club app to use Scan & Go.

Way to go, Sam’s Club!